Work Package 4: Analysis of the Effects of a Carbon Tax in Austria

Description

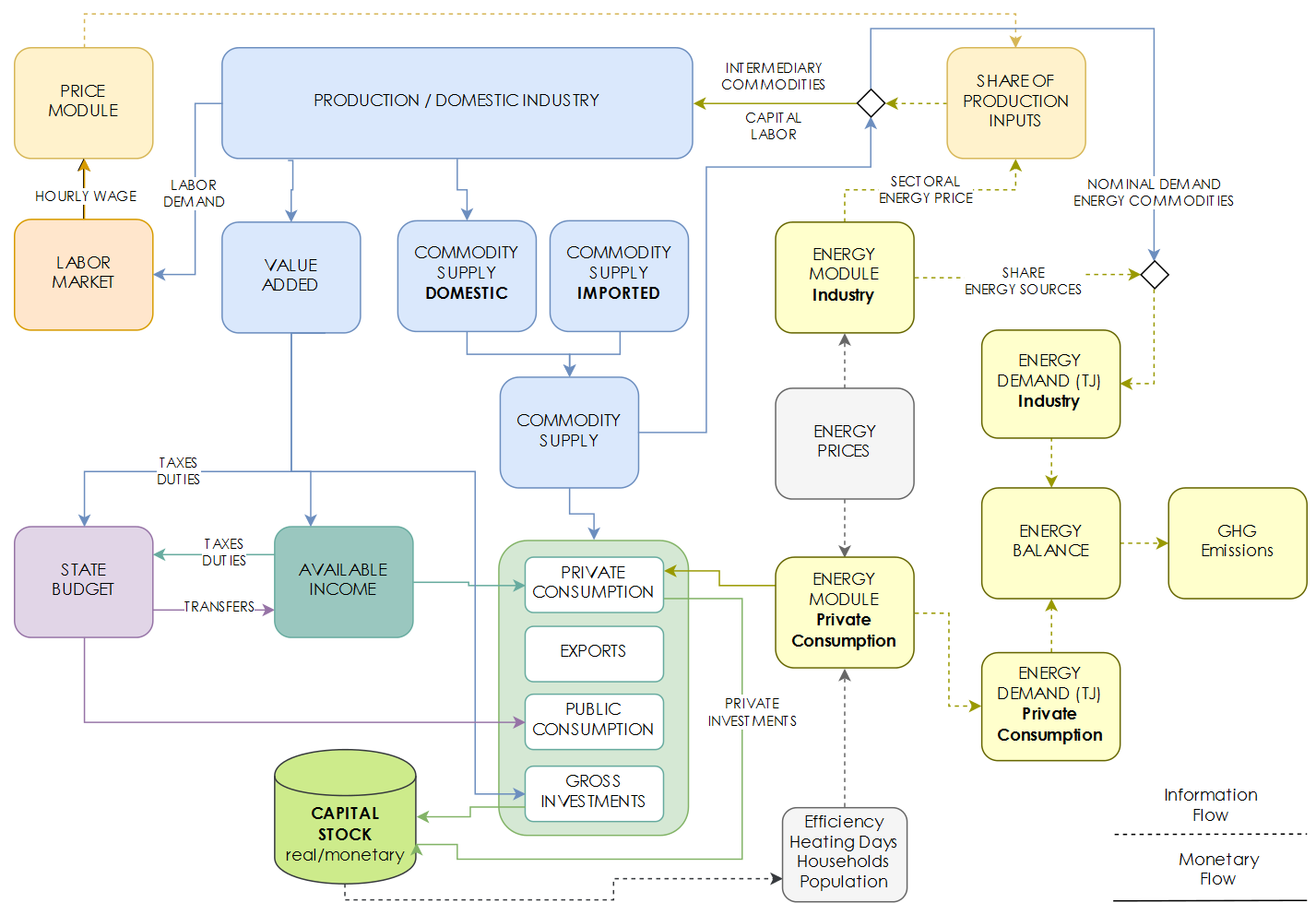

In Work Package 4, the WIFO-DYNK[AUT] (WIFO Dynamic New Keynesian Model for Austria) model was used to assess carbon tax scenarios for Austria. The DYNK[AUT] model traces the inter-linkages between 62 industries and final users (e.g. private consumption, gross fixed capital formation, public consumption). It further differentiates between five household income groups and models energy consumption explicitly (for households as well as industry & service sectors). The model draws on New-Keynesian (i.e. long-run full employment equilibrium and institutional rigidities) as well as neo-classical economic theory (i.e. theory of firm, almost ideal demand system) and can be considered a hybrid form between CGE and static IO models. The DYNK model is an input-output model in the sense that it is demand-driven, as all that is demanded is produced. However, static input-output relationships are extended by the incorporation of econometrically estimated behavioural functions for industry & service sectors (estimating input shares of capital, labour, energy as well as domestic and imported materials), the labour market (sticky wage curves), and private households (durable and non-durable commodities as well as energy service demand). DYNK[AUT] also accounts for household income and wealth, changes in gross fixed capital formation (depending on changes in net surpluses for each sector), as well as government expenditure and revenue.

A schematic overview of DYNK

In CATs, the model has been specifically updated with household income data for Austria (EU-SILC, Austrian Consumption Survey), and the module for (private) passenger transport was expanded in order to represent the demand for mobility in physical units. This permits a more detailed representation of the energy price effects on mobility. Furthermore, we also adjusted the model to allow for a more consistent approach of integrating CO2 price effects in the model. The detailed modelling of energy demand enables the implementation of energy / CO2 taxation with specific designs that takes into account issues of technology choice as well as of income distribution:

- Based on the empirical assessment in Work Package 2, a set of scenarios for the introduction of a CO2 tax in Austria was developed. One set of scenarios assumed that different CO2 tax rates were implemented only in non-ETS sectors; another set of scenarios also implemented a floor price for the ETS sectors.

- The effects of the taxes were assessed with and without revenue recycling. The recycling options included lump-sum payments for households and reductions of the employers' social contributions for the service and industry sectors. With respect to households a differentiation between household income quintiles was implemented in order to mitigate the negative effects for lower income quintiles.

- (iii) An energy / CO2 tax was levied at the level of durables, i.e. an increase of the vehicle registration tax (NoVA), so that the energy/carbon efficiency of the vehicle stock could be altered.

Scenarios

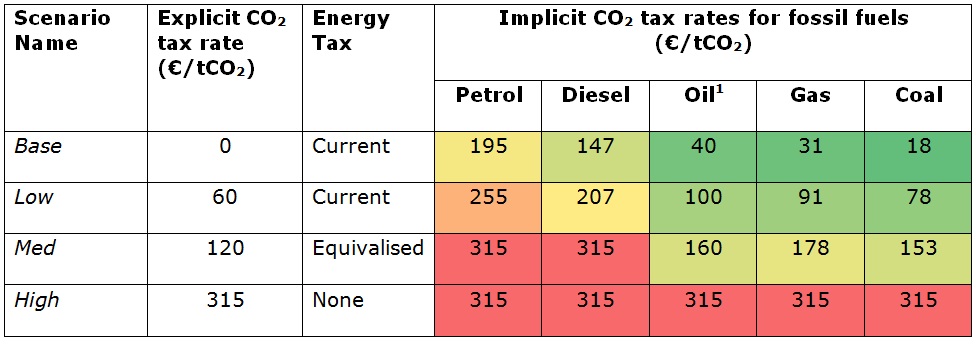

WP4 provided a macroeconomic assessment of distributive, macroeconomic, and CO2 emission impacts of different CO2 tax scenarios in Austria. The scenarios aimed at covering a reasonable range of tax rate variants (see Table) and tax recycling schemes. The main focus of the scenarios was on energy-related CO2 emissions generated in non-ETS sectors, i.e. mostly CO2 emissions from energy consumption by private households, transport and service sectors. In addition three additional scenarios were provided: (1) a floor price for ETS sectors; (2) an increase in the vehicle registration tax (NoVA) for vehicle purchase; and (3) policy scenarios until 2030.

CO2 tax rate scenarios for Austria

CO2 tax recycling/compensation scenarios for Austria

- NoRec: No tax recycling

- RecH: All CO2 tax revenues are recycled via equal per-capita lump sum payments to all households (H)

- RecH[low]: All CO2 tax revenues are recycled via equal per-capita lump sum payments to the three lowest households (H) income groups (QNT1 to QNT3)

- RecQ: All CO2 tax revenues are recycled via uniformly reduced employers’ social contribution for industry & service sectors (Q) affected

- RecQH: CO2 tax revenues from households (H) are recycled as in RecH & CO2 tax revenues from industry & service sectors (Q) are recycled as in RecQ

- RecQH[low]: CO2 tax revenues from households (H) are recycled as in RecH [low] & CO2 tax revenues from industry & service sectors (Q) are recycled as in RecQ

Results

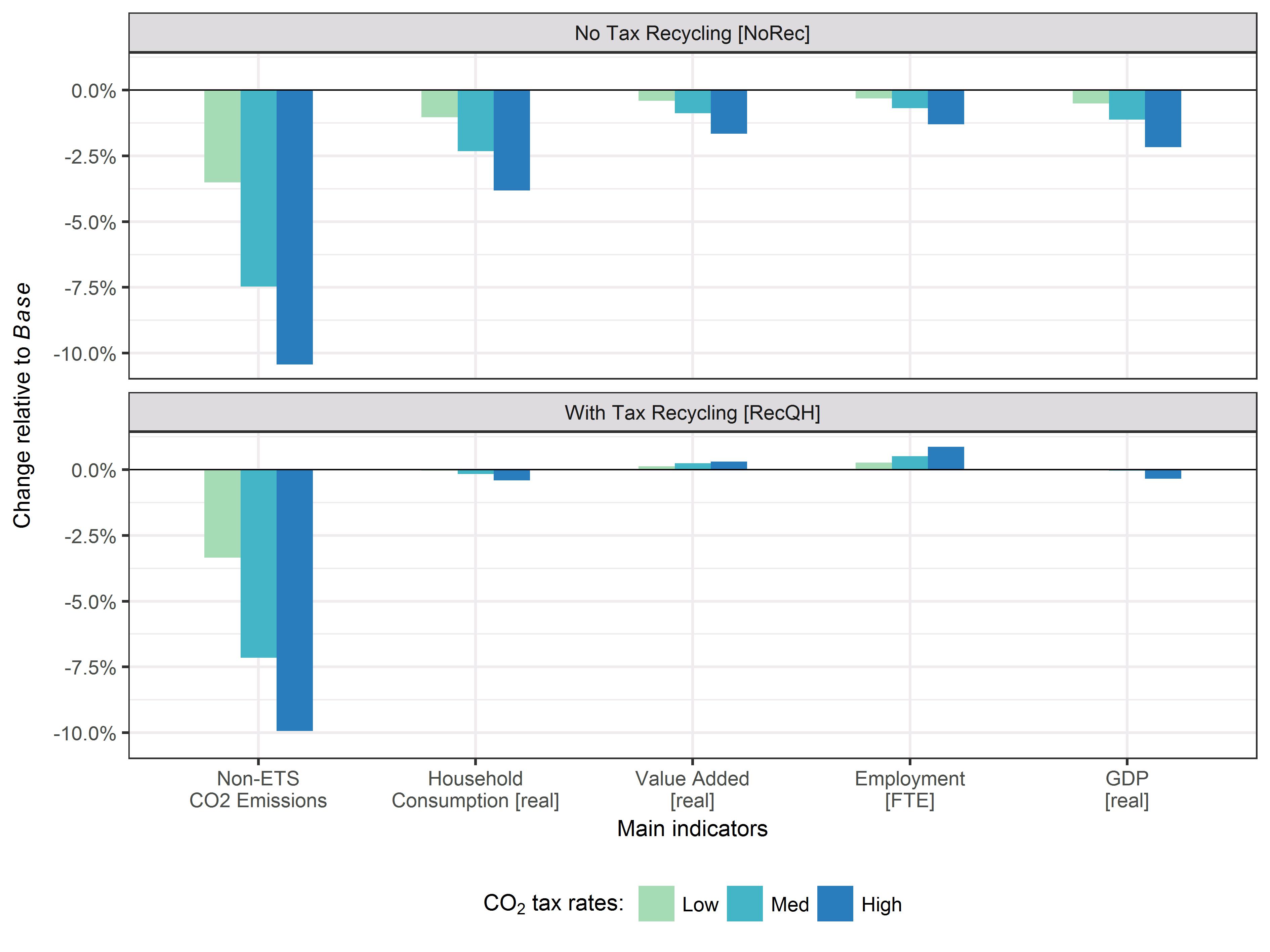

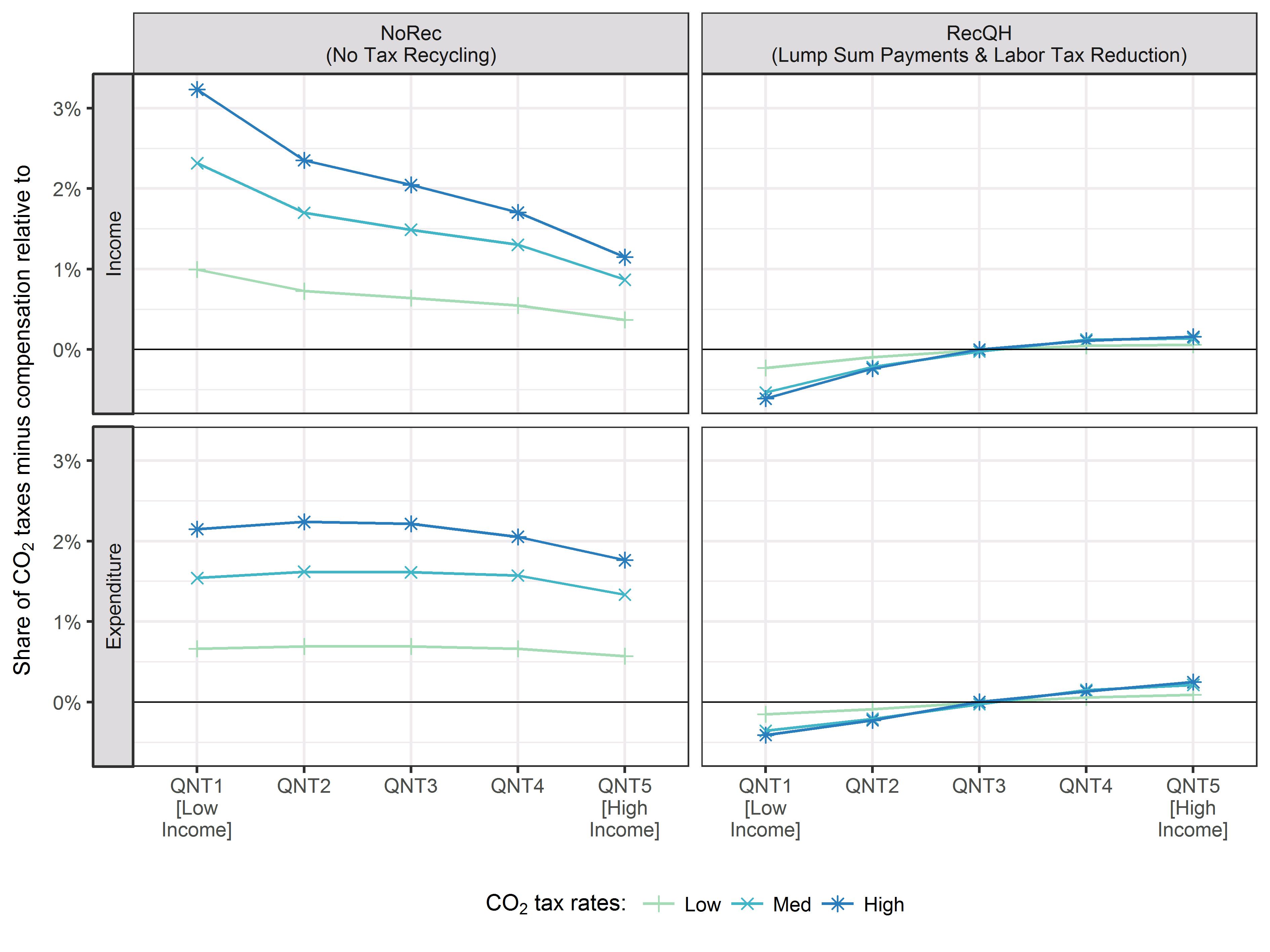

An overview of impacts on our main indicators is shown in Figure 2. It depicts the range of our CO2 tax scenarios and highlights the impact of introducing a revenue neutral tax policy (RecQH vs. NoRec). In all scenarios non-ETS CO2 emissions decrease substantially, with up to 10% in a high tax rate scenario. Rebound effects due to recycling schemes are minimal. Macroeconomic impacts are moderate without tax recycling (NoRec) and impacts on the competitiveness of domestic commodities remain small. Decreases in value added, employment and GDP are well below 2.5%. Tax recycling (RecQH) mitigates these moderately negative economic effects and net impacts on our macro-economic indicators become negligible. Small positive effects are shown for employment due to lower labour costs. Figure 3 further shows that CO2 taxes without tax recycling can have regressive impacts if measured as “tax burden relative to income”, but rather proportional if measured as “tax burden relative to expenditure”. Tax recycling in the form of lump sum eco-payments (RecQH) leads to progressive impacts in both indicators. Trade-offs exist between economic efficiency vs. equity, i.e. labor tax cuts are more efficient than lump sum payments, but perform less well on equity. Our additional model scenarios show that (i) impacts remain moderate even if a floor price for ETS sectors is introduced; (ii) increases in the vehicle registration tax have a larger impact on household CO2 emissions than a CO2 tax on fuels; and (iii) that further efforts are necessary to reach emission targets for 2030. Our model simulations thus indicate that adequate CO2 tax policies are able to achieve a double dividend in Austria, i.e. reductions in emission with non-negative or positive economic effects, as well as to mitigate potentially negative impacts on competitiveness and equity.

Impact on main indicators

Tax burden impacts on household income groups

The working paper on the model simulations of CO2 tax policies for Austria is available for download here: